Prop trading thrives on discipline, structure, and strategy — not gambling. While the temptation of quick profits can push traders into reckless behavior, this approach almost never leads to lasting success.

At FTG Funding, we’ve seen firsthand that the traders who thrive are the ones who treat trading like a business, not a bet. Gambling in trading isn’t just risky — it’s unsustainable. It undermines the principles of risk management, consistency, and long-term growth that are vital for prop trading.

Understanding Gambling in Trading

Understanding Gambling in Trading

Gambling in trading happens when traders take impulsive, high-risk trades without proper planning, analysis, or risk management.

Common Signs of Gambling in Trading:

Lack of Strategy → Entering trades on emotions or “gut feelings” instead of analysis.

Excessive Risk-Taking → Using oversized leverage or margin to chase quick profits.

Impulsive Decisions → Revenge trading or overtrading after a loss.

Neglecting Risk Management → Skipping stop-losses, poor position sizing, or trading recklessly during volatile periods.

Why Gambling Hurts Prop Trading Firms

Why Gambling Hurts Prop Trading Firms

Prop trading firms exist to build a sustainable ecosystem for both the firm and its traders. Gambling-like behavior disrupts this system in several ways:

Inconsistent Performance – Gambling may bring short bursts of wins, but losses are far greater long-term.

Psychological Stress – Emotional trading creates burnout and poor decision-making.

Financial Losses – Reckless behavior often leads to account breaches and failed challenges.

Loss of Trust – Firms need reliable traders. Gambling destroys trust and usually results in account termination.

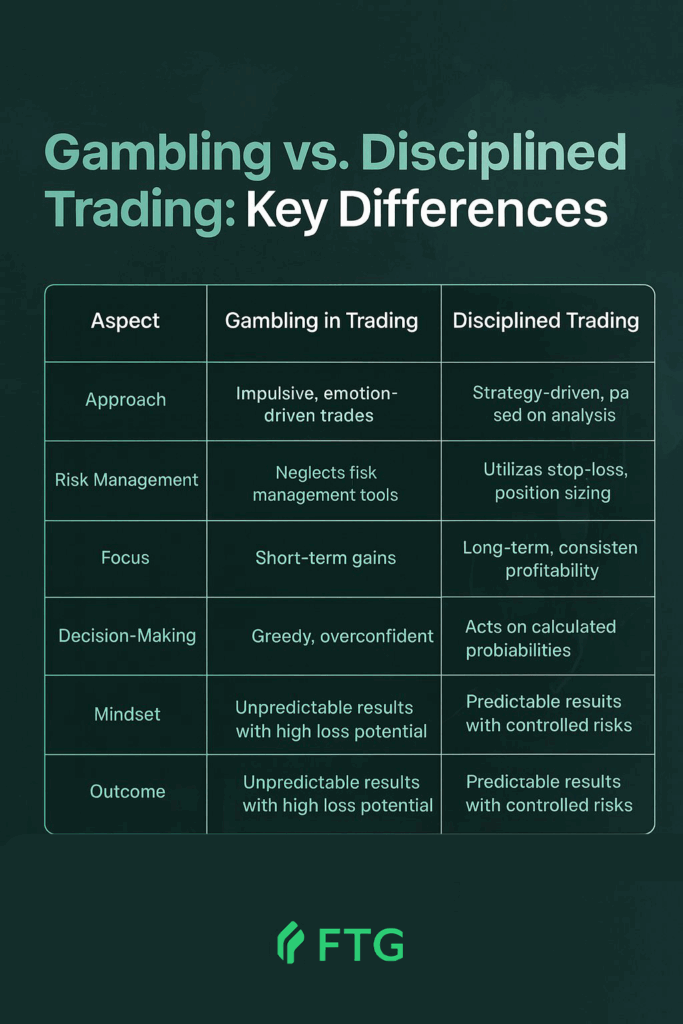

Gambling vs. Disciplined Trading: Key Differences

Gambling vs. Disciplined Trading: Key Differences

Gambling Traders  | Disciplined Traders  |

|---|---|

| Impulsive, emotion-driven | Strategy-based, data-driven |

| Ignore risk tools (no stop-loss, oversized lots) | Use risk tools (stop-loss, 1% risk per trade) |

| Seek quick wins | Focus on long-term consistency |

| Fueled by greed or fear | Guided by patience and resilience |

| End with unpredictable losses | Build repeatable, controlled results |

Real Example: Gambling Gone Wrong

Real Example: Gambling Gone Wrong

One FTG trader purchased a $200K Challenge account. Instead of applying proper risk management, they:

- Opened 15-lot XAUUSD trades at once

- Used nearly 78% of account margin in a single position

- Placed no stop-loss

A single market move against them was enough to breach the Daily Drawdown Limit. Instead of adjusting, the trader chased losses with reckless, emotional trades.

The result? While some trades were profitable, they couldn’t offset the mounting losses. The account breached, and the Challenge failed.

How FTG Funding Tackles Gambling

How FTG Funding Tackles Gambling

At FTG Funding, we encourage traders to grow into disciplined professionals. To protect traders from destructive habits, we implement:

- Risk Limits → Encouraging 1% or less per trade

- Margin Discipline → Professionals rarely exceed 20–30% of margin usage

- Account Protections → In repeated cases of gambling-like behavior, measures like reduced leverage or capped lot sizes may apply

These safeguards aren’t meant to restrict traders — they’re designed to help you avoid self-sabotage and stay on the path to long-term growth.

Conclusion

Conclusion

Success in prop trading isn’t about luck or chance — it’s about discipline, patience, and structured strategies. Gambling behaviors may offer a quick thrill, but they almost always end in failure and frustration.

At FTG Funding, our mission is to empower traders to focus on sustainable success. Because in the end, disciplined trading isn’t just the safest approach — it’s the only path to long-term profitability.