Failure in trading is something most people avoid discussing — yet every serious trader faces it at some point. Often, that failure comes during the FTG Challenge, a test built not only to evaluate your strategy, but also your resilience and discipline under pressure.

It’s natural to feel frustration or self-doubt after failing. But here’s the truth: failure isn’t the end of the journey — it’s the beginning. What matters most isn’t the failure itself, but how you respond.

✅ Failure is Normal

The FTG Challenge is designed to test:

- How you make decisions under stress

- How you manage uncertainty

- How disciplined you remain under pressure

Failing doesn’t mean you’re not good enough. It simply highlights your current limits — technical, mental, or emotional. And those limits show you exactly where growth is possible.

👉 Many traders blame the system. The best traders, however, use failure as a mirror for self-reflection. Ask yourself:

- Am I trading with discipline?

- Can I stick to my plan during drawdowns?

- Am I managing risk calmly, without emotion?

Ironically, failure often reveals these truths more clearly than success.

🪞 What the FTG Challenge Teaches You

The FTG Challenge is more than rules and objectives — it’s a reflection of your trading behavior. It shows:

- When you allow impulse to override discipline

- How you react to drawdowns, break-even trades, or small wins

- Whether you trade your plan or your emotions

This feedback is priceless. It helps you grow into a more disciplined, self-aware, and consistent trader.

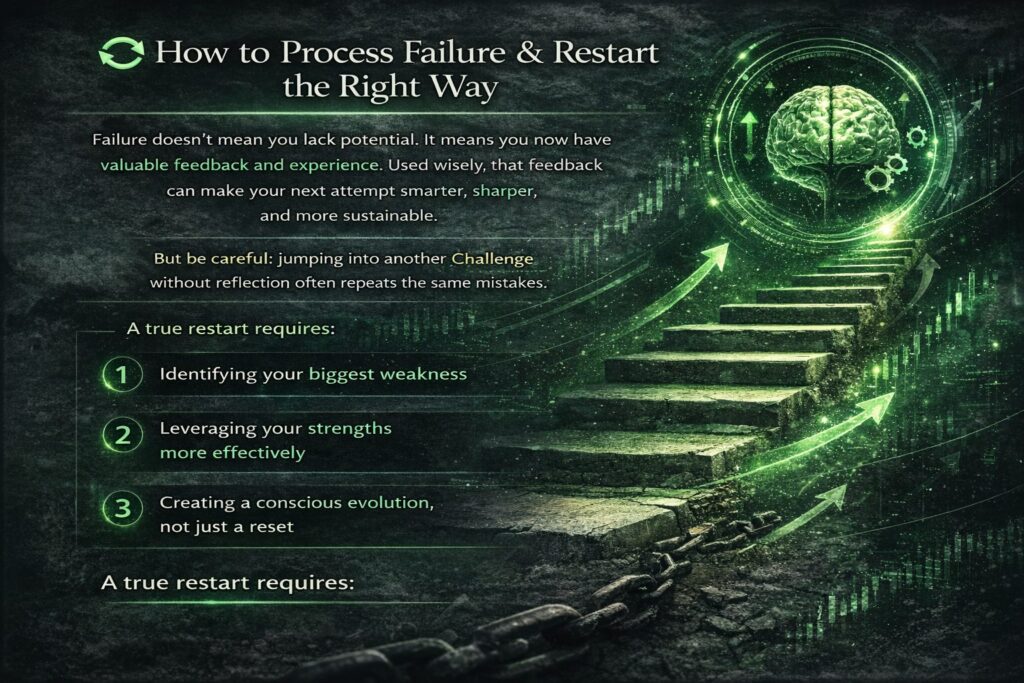

🔄 How to Process Failure & Restart the Right Way

Failure doesn’t mean you lack potential. It means you now have valuable feedback and experience. Used wisely, that feedback can make your next attempt smarter, sharper, and more sustainable.

But be careful: jumping into another Challenge without reflection often repeats the same mistakes.

A true restart requires:

- Identifying your biggest weakness

- Leveraging your strengths more effectively

- Creating a conscious evolution, not just a reset

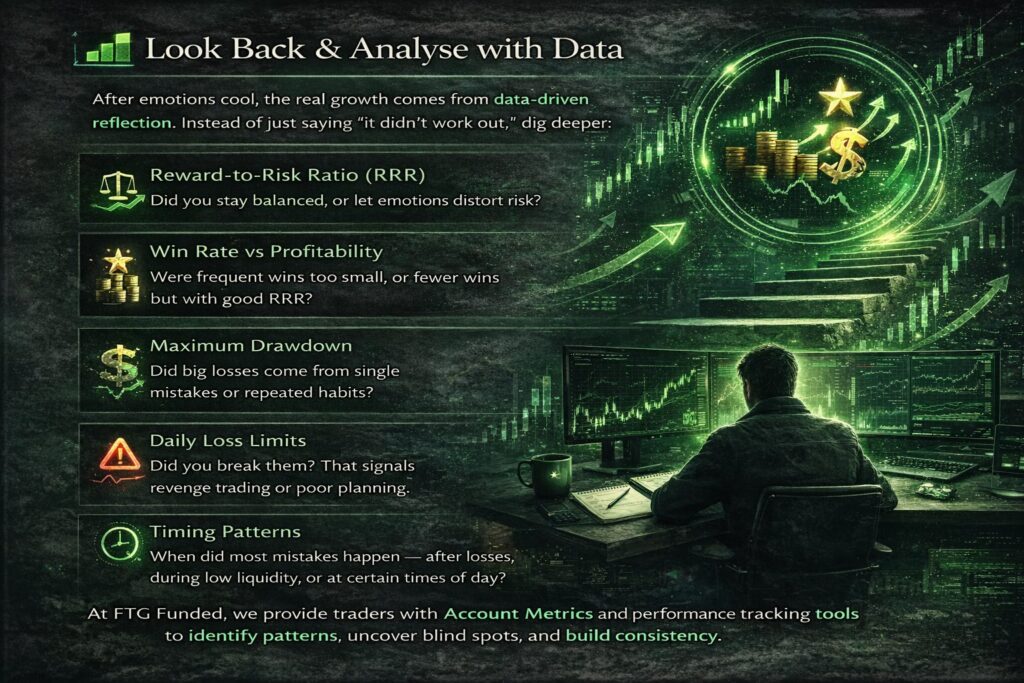

📊 Look Back & Analyse with Data

After emotions cool, the real growth comes from data-driven reflection. Instead of just saying “it didn’t work out,” dig deeper:

- Reward-to-Risk Ratio (RRR): Did you stay balanced, or let emotions distort risk?

- Win Rate vs Profitability: Were frequent wins too small, or fewer wins but with good RRR?

- Maximum Drawdown: Did big losses come from single mistakes or repeated habits?

- Daily Loss Limits: Did you break them? That signals revenge trading or poor planning.

- Timing Patterns: When did most mistakes happen — after losses, during low liquidity, or at certain times of day?

At FTG Funded, we provide traders with Account Metrics and performance tracking tools to identify patterns, uncover blind spots, and build consistency.

💪 Ready to Try Again — The Right Way?

Failure in the FTG Challenge isn’t a dead end. It’s a stepping stone. If you treat failure as feedback, it often drives more progress than success ever could.

When you return, you’ll do so with:

- Greater self-awareness

- A stronger mindset

- A clearer, refined plan

👉 At FTG Funded, we believe failure is not the end — it’s the beginning. Every setback is an opportunity to grow into the disciplined professional trader you aspire to be.

Are you ready to turn failure into fuel? Start your next FTG Challenge with fresh perspective and take the first step toward mastery.