Why Prop Firms Are Trending Among Traders

If you’ve been scrolling through trading Twitter, YouTube, or Telegram, you’ve probably seen the buzz around prop firms. But what exactly is a prop firm, and why are so many traders turning to them instead of trading with their own savings? More importantly—how does a firm like FTG Funding, in partnership with DAK Markets, help you scale up to maximum allocation while managing risk like a professional? Let’s break it down.

Prop Firm 101: What It Actually Is

Defining a Proprietary Trading Firm

A proprietary trading firm, or prop firm, is a company that allows qualified traders to trade with firm capital instead of their own. Traders don’t deposit huge sums into a personal account—instead, they prove their skills through an evaluation process.

How Prop Firms Differ from Traditional Retail Trading

With retail trading, you fund your own account, shoulder all the risks, and often have limited scalability. A prop firm shifts the model: they carry the financial risk, you provide the skill, and profits are shared between trader and firm.

Why Traders Choose Prop Firms

Capital Efficiency

Instead of risking $10,000 of personal savings, a trader can trade a $50K, $100K, or even $400K FTG Funding funded account by paying a small evaluation fee.

Risk Framework & Discipline

Prop firms have rules that enforce discipline—daily loss limits, max drawdowns, and position sizing guidelines. For many traders, these act as guardrails that prevent account blow-ups.

Scalable Path to Growth

Unlike retail, where scaling depends on personal capital, prop firms offer a structured path to bigger allocations if you hit profit targets while respecting risk.

Professional Infrastructure

Through broker partnerships like FTG Funding x DAK Markets, traders gain access to institutional-grade pricing, liquidity, and platforms.

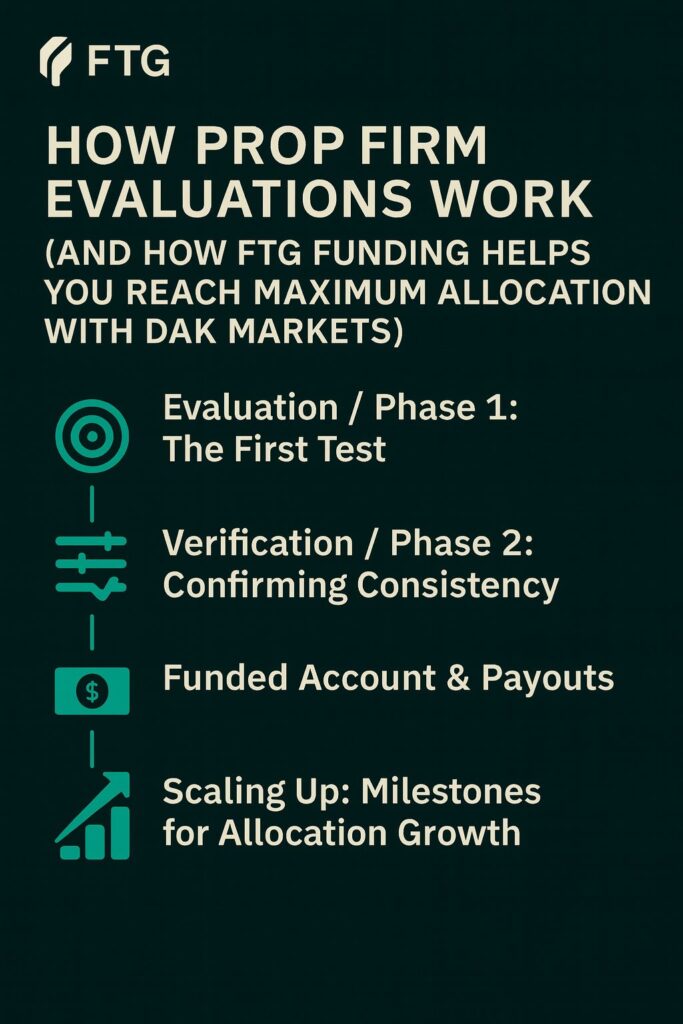

How Prop Firm Evaluations Work (In Plain English)

Evaluation / Phase 1: The First Test on FTG Funding

Your first task is to reach a profit target while respecting daily and maximum loss rules.

Verification / Phase 2: Confirming Consistency

If the firm uses a two-step model, which FTG Funding does, you’ll repeat the process with similar guidelines, proving your edge is not luck.

Funded Account & Payouts

Once funded on the FTG Funding account, you trade the firm’s capital, request payouts on schedule, and grow your track record.

Scaling Up: Milestones for Allocation Growth

Hit milestones (profit + consistency), and your allocation grows—sometimes up to seven figures with the best firms.

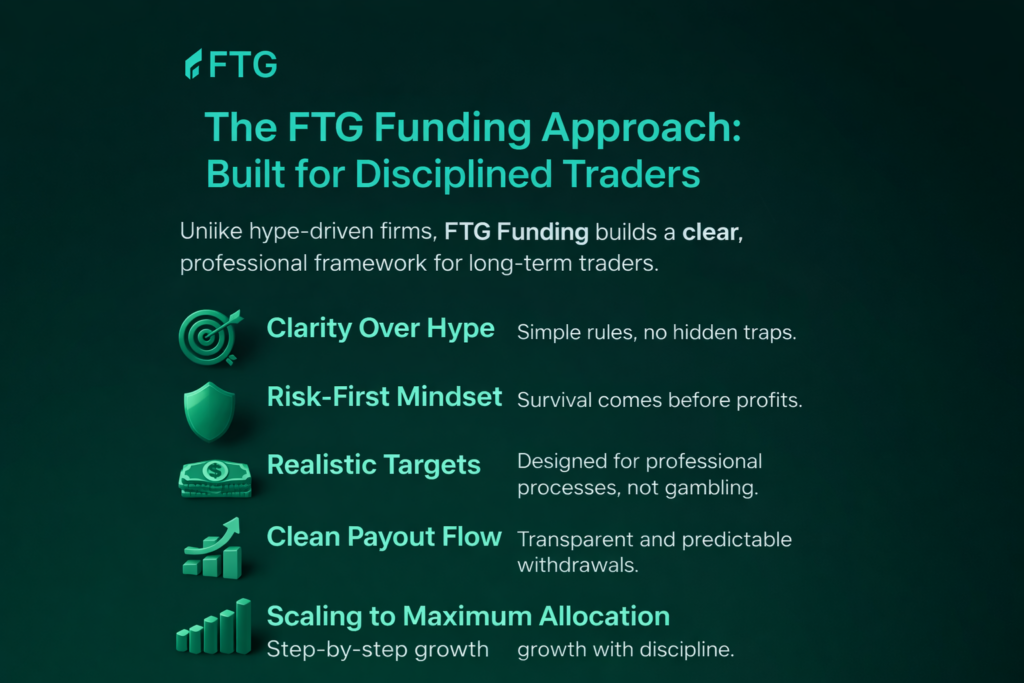

The FTG Funding Approach: Built for Disciplined Traders

Unlike hype-driven firms, FTG Funding builds a clear, professional framework for long-term traders.

- Clarity Over Hype – Simple rules, no hidden traps.

- Risk-First Mindset – Survival comes before profits.

- Realistic Targets – Designed for professional processes, not gambling.

- Clean Payout Flow – Transparent and predictable withdrawals.

- Scaling to Maximum Allocation – Step-by-step growth with discipline.

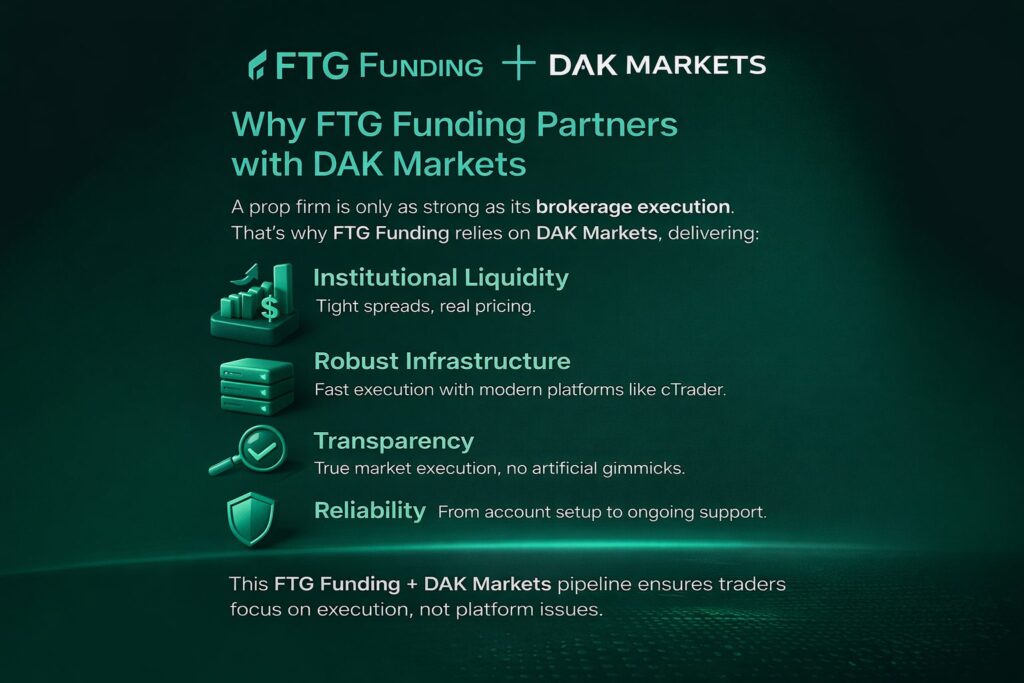

Why FTG Funding Partners with DAK Markets

A prop firm is only as strong as its brokerage execution. That’s why FTG Funding relies on DAK Markets, delivering:

- Institutional Liquidity – Tight spreads, real pricing.

- Robust Infrastructure – Fast execution with modern platforms like cTrader.

- Transparency – True market execution, no artificial gimmicks.

- Reliability – From account setup to ongoing support.

This FTG Funding + DAK Markets pipeline ensures traders focus on execution, not platform issues.

Reaching Maximum Allocation: What It Takes

Success in prop trading comes from process, not shortcuts. Here’s what separates winners:

- Master the Rules – Drawdown, news rules, lot size limits.

- Trade Your Playbook – Stick to 1–2 setups you know best.

- Respect Risk to the Decimal – Position sizing + stop losses.

- Keep a Journal – Track setups, mistakes, and performance.

- Stack Quiet Months – Growth comes from steady consistency.

- Communicate & Document – Clear metrics = faster scaling approvals.

Common Myths About Prop Firms—Debunked

- Myth 1: Prop firms only sell challenges.

✅ Reality: Challenges filter for traders who can responsibly manage capital. - Myth 2: You need massive profits to scale.

✅ Reality: Steady, compliant profits matter far more than big days. - Myth 3: Brokers are rigged against traders.

✅ Reality: With DAK Markets, execution is transparent and institutional-grade.

Who Succeeds in Prop Trading? Traits of Winning Traders

- Patience – Knowing when not to trade.

- Process Fidelity – Following rules over chasing wins.

- Emotional Control – Logging and learning from losses.

- Risk Literacy – Thinking in R-multiples, not dollar signs.

Getting Started with FTG Funding

- Choose Your Evaluation – Pick an account size you can manage on FTG Funding.

- Read the Rules (Twice) – They protect you, not trap you.

- Trade the Plan – Focus on quality setups.

- Get Funded & Scale – Withdraw profits, hit milestones, grow allocation.

- Trade via DAK Markets – Professional execution at every step.

FAQs About Prop Firms and FTG Funding

Q1: What is the main benefit of a prop firm like FTG Funding?

A: It lets you trade large capital accounts without risking personal savings.

Q2: How much can I scale to with FTG Funding?

A: Traders who follow the rules and perform consistently can reach maximum allocation levels over time.

Q3: What platforms does DAK Markets support?

A: They provide modern, robust platforms such as cTrader, with fast execution.

Q4: Can I withdraw profits easily?

A: Yes, FTG Funding has a clean payout process with clear timelines.

Q5: Are prop firm challenges worth it?

A: Absolutely—if you’re disciplined, challenges act as risk filters that unlock access to an FTG Funding firm capital.

Q6: Do I need to be a full-time trader to succeed?

A: No, part-time traders can succeed if they stick to their rules and setups consistently.

Conclusion: Trading Professionally with FTG Funding & DAK Markets

A serious prop firm isn’t a casino—it’s a professional environment designed for disciplined traders. With FTG Funding’s structured framework and DAK Markets’ execution infrastructure, you gain a path to scaling safely to maximum allocation without risking your own capital.

If you’re ready to trade like a professional—with rules, risk control, and a scaling roadmap—the next step is clear:

👉 Apply for an FTG Funding evaluation today and start your journey to maximum allocation with DAK Markets as your trusted broker partner.