Successful trading is not about luck, secret indicators, or overnight profits. At FTG Funding, we see the same pattern repeatedly: traders who succeed long term are not necessarily the most aggressive or the most talented—but the most disciplined.

Whether you are preparing to pass a prop firm evaluation or aiming to scale a funded account, mastering the fundamentals of successful trading is non-negotiable. Below are the 10 essential factors that separate consistent traders from those who fail challenges again and again.

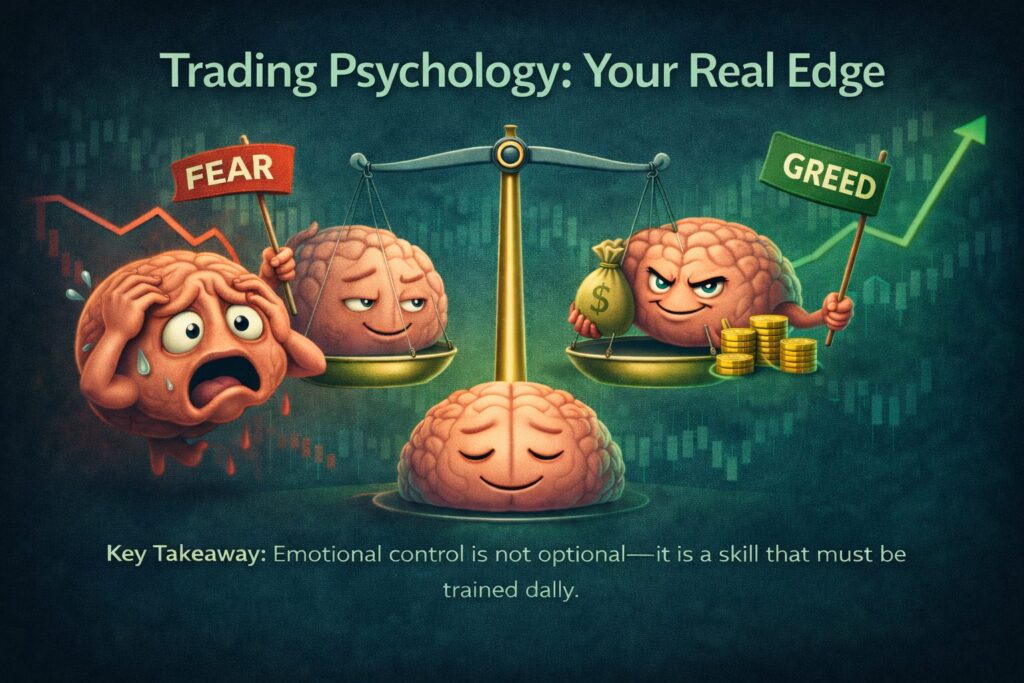

1. Trading Psychology: Your Real Edge

Markets test your emotions before they test your strategy. Fear, greed, frustration, and overconfidence destroy more accounts than bad analysis ever will.

A trader who cannot stay calm after a losing streak or disciplined after a winning run will eventually violate risk rules. Successful traders develop emotional awareness and treat trading as a professional process, not a gamble.

Key takeaway: Emotional control is not optional—it is a skill that must be trained daily.

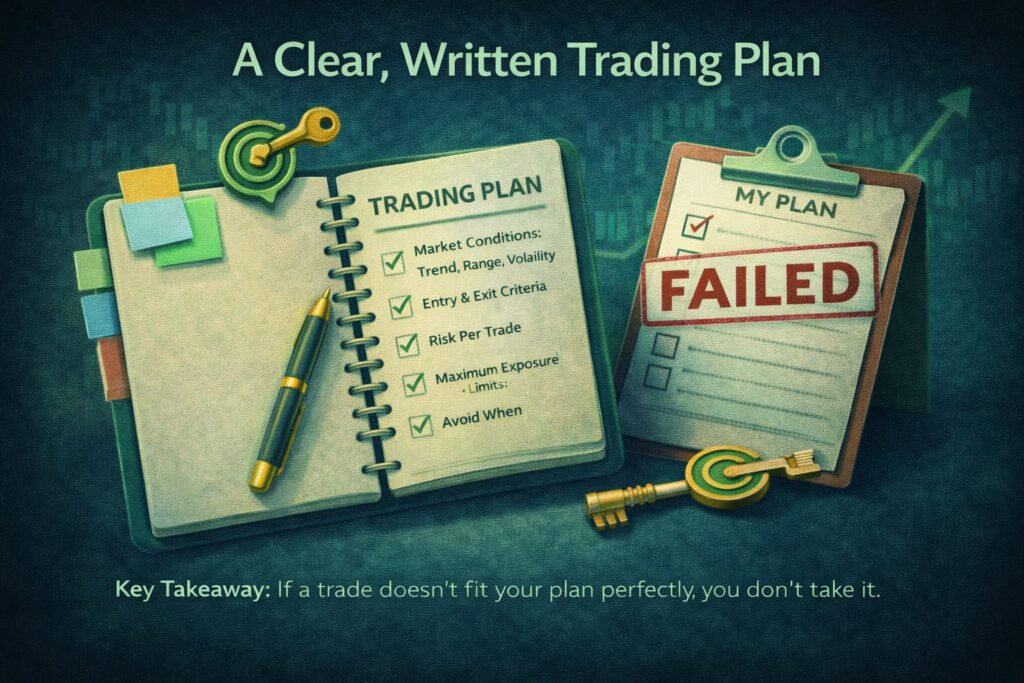

2. A Clear, Written Trading Plan

A trading plan is your operating system. Without it, decisions become impulsive and inconsistent.

Your plan should define:

- Market conditions you trade best (trending, ranging, high volatility, low volatility)

- Entry and exit criteria

- Risk per trade

- Maximum daily and weekly exposure

- When not to trade

At FTG Funding, traders who fail evaluations almost always deviate from their own plan.

Key takeaway: If a trade doesn’t fit your plan perfectly, you don’t take it.

3. Risk Management Over Profit Chasing

Profit is a byproduct of proper risk control—not the other way around.

Successful trading focuses on capital preservation first. One oversized position can undo weeks of consistent gains, especially under prop firm rules.

Professional traders typically risk between 0.25% and 1% per trade, depending on strategy and volatility.

Key takeaway: Survivability in the market is more important than any single trade.

4. Strategy Testing and Data Confidence

You cannot trust a strategy you have not tested.

Backtesting and forward testing build statistical confidence and remove emotional doubt. If you know your system has an edge over 100+ trades, short-term losses will not shake your discipline.

Unverified strategies create hesitation—and hesitation leads to mistakes.

Key takeaway: Confidence comes from data, not hope.

5. Continuous Education and Adaptability

Markets evolve. What worked last year may stop working this year.

Successful traders are students of the game. They study:

- Market structure

- Liquidity behavior

- Macroeconomic drivers

- Execution refinement

At FTG Funding, we value traders who adapt, not traders who stay stuck defending outdated ideas.

Key takeaway: Learning never stops if you want to stay funded.

6. Technical and Fundamental Awareness

Technical analysis helps you identify where to trade. Fundamental awareness helps you understand when not to trade.

Ignoring major economic releases, central bank decisions, or high-impact news can lead to unnecessary volatility exposure.

Professional traders align technical execution with fundamental context.

Key takeaway: Charts matter—but context matters more.

7. Daily Routine and Consistency

Successful trading is boring—and that’s a good thing.

Top traders follow a structured routine:

- Pre-market preparation

- Defined trading hours

- Post-trade review

- End-of-day journaling

Random trading hours lead to random results.

Key takeaway: Consistency in routine creates consistency in performance.

8. Trading Journal and Honest Feedback

A trading journal is your mirror.

It reveals:

- Emotional patterns

- Execution mistakes

- Strengths worth scaling

- Weaknesses that must be eliminated

Most traders avoid journaling because it exposes uncomfortable truths. Professionals embrace it.

Key takeaway: What you measure, you improve.

9. Patience and Long-Term Thinking

Successful trading careers are built over years, not weeks.

Drawdowns are normal. Losing streaks are inevitable. The difference is how you respond.

Patient traders adjust risk, reduce exposure, or step aside when conditions are unfavorable. Impatient traders revenge trade and self-destruct.

Key takeaway: The market rewards patience more than intelligence.

10. Performance Metrics Beyond Profit

Profit alone does not define a good trader.

Professional evaluation includes:

- Profit factor

- Risk-to-reward ratio

- Drawdown control

- Consistency

- Rule adherence

At FTG Funding, we care about how profits are made—not just how much.

Key takeaway: Sustainable performance beats lucky months.

Final Thoughts: Success Is Built, Not Discovered

Successful trading is the result of discipline, structure, and self-mastery. There are no shortcuts.

At FTG Funding, our mission is to identify and support traders who understand that long-term success comes from rules, not impulses—and from consistency, not ego.

If you are committed to treating trading like a professional career rather than a hobby, you are already ahead of most participants in the market.

Trade smart. Trade disciplined. Trade for longevity.

Ready to take the next step toward becoming a funded trader? FTG Funding is built for traders who value structure, risk control, and sustainable growth.