Building a trading strategy is one of the most important steps in a trader’s journey—yet it is also one of the most misunderstood. Many traders confuse a few indicators or chart patterns with a strategy, only to discover that inconsistency and rule violations quickly follow.

At FTG Funding, we see a clear distinction between traders who pass evaluations and those who fail repeatedly. The difference is rarely intelligence or market knowledge. It is structure.

Below are the 10 essential steps to building a trading strategy that is clear, testable, and sustainable—especially in a prop firm environment.

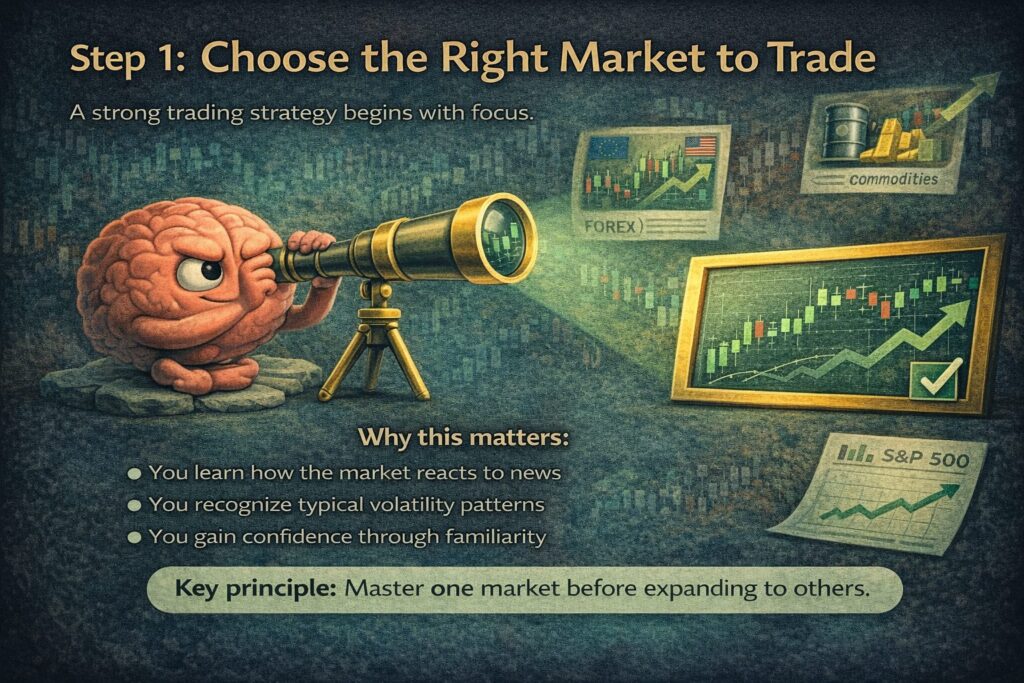

Step 1: Choose the Right Market to Trade

A strong trading strategy begins with focus.

Rather than jumping between dozens of instruments, successful traders specialize in a small number of markets they truly understand. This could be a major forex pair, a stock index, commodities, or a single asset with consistent behavior.

Why this matters:

- You learn how the market reacts to news

- You recognize typical volatility patterns

- You gain confidence through familiarity

Key principle: Master one market before expanding to others.

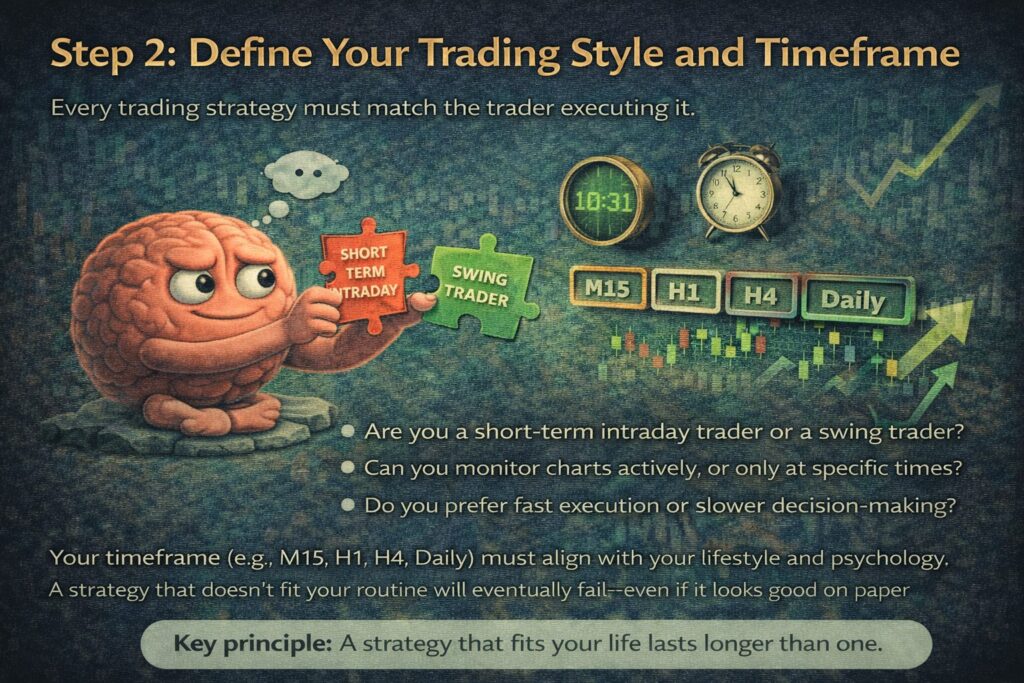

Step 2: Define Your Trading Style and Timeframe

Every trading strategy must match the trader executing it.

Ask yourself:

- Are you a short-term intraday trader or a swing trader?

- Can you monitor charts actively, or only at specific times?

- Do you prefer fast execution or slower decision-making?

Your timeframe (e.g., M15, H1, H4, Daily) must align with your lifestyle and psychology. A strategy that doesn’t fit your routine will eventually fail—even if it looks good on paper.

Key principle: A strategy that fits your life lasts longer than one that doesn’t.

Step 3: Select Simple and Complementary Tools

Complexity does not equal profitability.

The best trading strategies use simple, well-understood tools that complement each other rather than repeat the same information. Whether you use indicators, price action, or structure-based analysis, clarity is essential.

Good tools should:

- Serve a clear purpose

- Be easy to interpret

- Reduce decision fatigue

Avoid stacking indicators that measure the same thing. Simplicity improves execution and discipline.

Key principle: If your chart is confusing, your decisions will be too.

Step 4: Define Precise Entry Conditions

A trading strategy without precise entry rules is incomplete.

Your entry conditions must be objective and repeatable, not based on feelings or intuition. A good entry rule answers one question clearly:

“What exact conditions must be present for me to enter a trade?”

Entries should be:

- Clearly defined

- Consistent across trades

- Independent of emotions

If you cannot explain your entry in one sentence, it is not precise enough.

Key principle: If you hesitate, you don’t enter.

Step 5: Define Clear Exit Rules (Stop Loss & Take Profit)

Exits are more important than entries.

Every trading strategy must define:

- Where you exit if you are wrong (stop loss)

- Where you exit if you are right (take profit)

- Under what conditions you exit early

Your exit rules protect your capital and your psychology. In a prop firm environment, unclear exits often lead to rule violations and unnecessary drawdowns.

Key principle: Know your exit before you enter.

Step 6: Set Fixed Risk Per Trade

Risk management is the foundation of any professional trading strategy.

Successful traders decide how much to risk before entering, not after. Risk is usually defined as a fixed percentage of the account per trade.

This approach:

- Keeps losses controlled

- Prevents emotional position sizing

- Protects you during losing streaks

In prop firm trading, disciplined risk management is often the difference between passing and failing.

Key principle: Control risk first—profits come later.

Step 7: Backtest the Strategy Thoroughly

A strategy that has never been tested is an assumption—not a system.

Backtesting allows you to:

- Evaluate performance over time

- Identify drawdowns and losing streaks

- Build statistical confidence

You should test your strategy over a meaningful sample size, ideally across different market conditions. The goal is not perfection, but consistency.

Key principle: Data replaces doubt.

Step 8: Validate the Strategy in Real-Time Conditions

Before trading real capital or entering a challenge, your strategy must be validated in real-time market conditions.

This step helps you:

- Practice execution

- Identify psychological weaknesses

- Confirm that the strategy works live, not just historically

Many traders skip this step and pay the price later. Real-time validation is where theory becomes reality.

Key principle: Practice the process, not just the idea.

Step 9: Track Performance with a Trading Journal

A trading journal transforms experience into improvement.

Your journal should track:

- Entry and exit reasons

- Risk and reward

- Emotional state

- Rule adherence

Over time, patterns emerge—both positive and negative. Traders who journal consistently improve faster because they learn from facts, not memory.

Key principle: What you track, you improve.

Step 10: Review, Refine, and Stay Consistent

Markets change, and strategies must evolve—but not impulsively.

Regular reviews allow you to:

- Identify weaknesses

- Adjust parameters logically

- Maintain alignment with market conditions

Refinement should be measured and intentional, not emotional. The goal is steady improvement, not constant reinvention.

Key principle: Consistency beats constant change.

Final Thoughts: Strategy Is a Process, Not a Shortcut

Building a trading strategy is not about finding a “holy grail.” It is about creating a structured, disciplined process that you can execute repeatedly under pressure.

At FTG Funding, we believe successful traders are built through:

- Clear rules

- Controlled risk

- Consistent execution

- Long-term thinking

If you commit to these 10 steps and treat trading as a professional discipline, you dramatically increase your chances of long-term success—both in evaluations and beyond.

Build the process. Respect the rules. Let consistency do the rest.