Pass a prop firm challenge

Mastering Forex trading isn’t just about reading charts — it’s also about reading yourself. Success in trading requires a balance of:

- 📊 Technical skills

- ⚖️ Risk management

- 🧠 Emotional intelligence

At FTG Funding, we believe the traders who succeed are the ones who stay disciplined under pressure. Emotional reactivity, greed, and fear are the true enemies of consistency.

When decisions are driven by emotions, traders abandon strategies and take reckless risks. Successful trading, on the other hand, comes from logic, analysis, and discipline — not impulse.

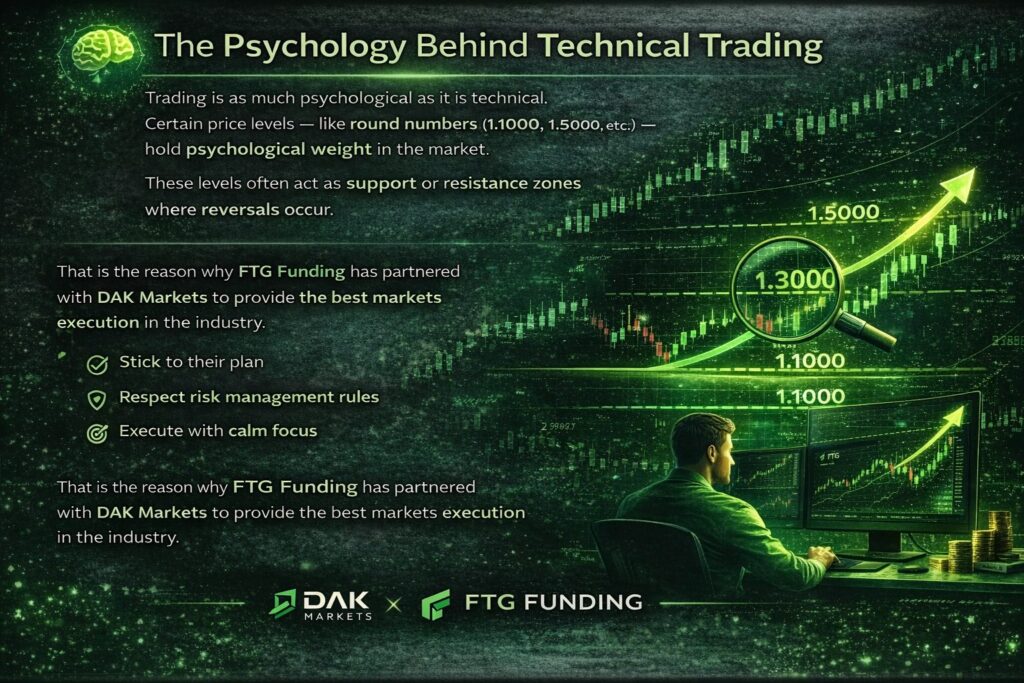

🧠 The Psychology Behind Technical Trading

Trading is as much psychological as it is technical. Certain price levels — like round numbers (1.1000, 1.5000, etc.) — hold psychological weight in the market. These levels often act as support or resistance zones where reversals occur.

That is the reason why FTG Funding has partnered with DAK Markets to provide the best markets execution in the industry.

Disciplined traders recognize these levels but don’t let emotions dictate their actions. Instead of chasing impulsive moves, they:

- Stick to their plan

- Respect risk management rules

- Execute with calm focus

📋 7 Tips to Strengthen Discipline in Trading

- Set and Stick to a Strategy

- Define your risk, entry, and exit rules. Adapt when necessary, but don’t trade blindly.

- Define your risk, entry, and exit rules. Adapt when necessary, but don’t trade blindly.

- Practice Before You Risk

- Use demo or Challenge accounts to build confidence before trading larger capital.

- Use demo or Challenge accounts to build confidence before trading larger capital.

- Smart Position Sizing

- Limit exposure to around 1% of account equity per trade. Protects you from emotional swings.

- Limit exposure to around 1% of account equity per trade. Protects you from emotional swings.

- Use Stop-Loss Orders

- Automate risk management to remove emotional decision-making.

- Automate risk management to remove emotional decision-making.

- Diversify

- Spread exposure across assets. Avoid going “all in” on one pair or setup.

- Spread exposure across assets. Avoid going “all in” on one pair or setup.

- Stay Calm with a Routine

- Create a pre-trading checklist. Breathe, review, and focus before execution.

- Create a pre-trading checklist. Breathe, review, and focus before execution.

- Respect Limits

- Don’t overtrade after wins or chase after losses. Discipline means knowing when to step back.

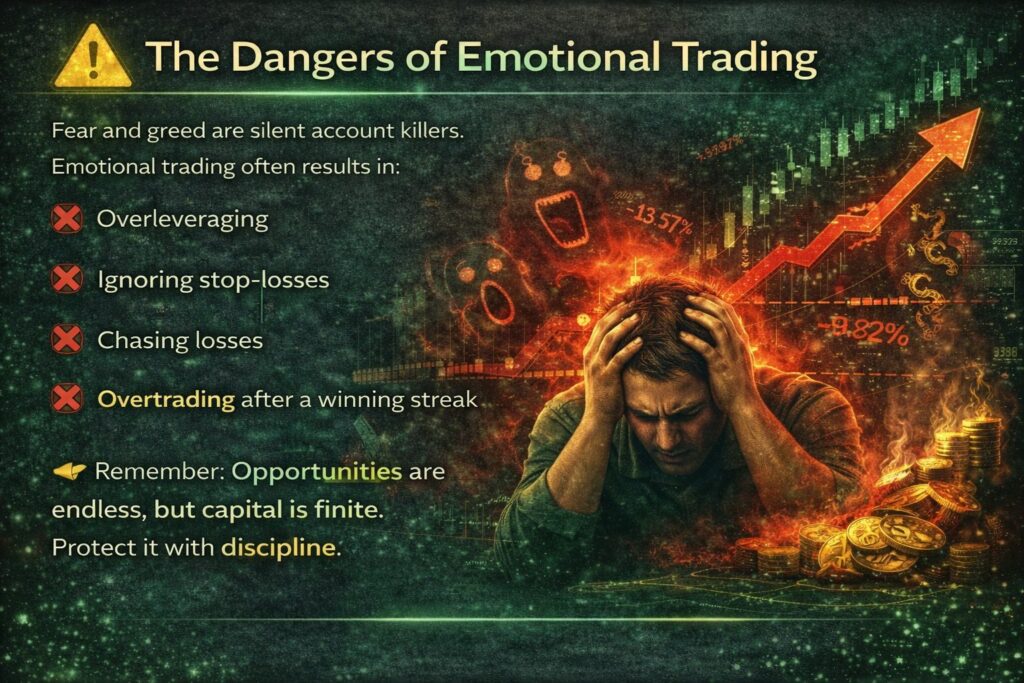

⚠️ The Dangers of Emotional Trading

Fear and greed are silent account killers. Emotional trading often results in:

- ❌ Overleveraging

- ❌ Ignoring stop-losses

- ❌ Chasing losses

- ❌ Overtrading after a winning streak

👉 Remember: Opportunities are endless, but capital is finite. Protect it with discipline.

🎯 Why FTG Funding Values Discipline

At FTG Funding, we don’t just provide traders with capital — we help them learn to manage it responsibly.

That’s why our programs are designed to:

- Reward discipline, consistency, and resilience

- Encourage strategic risk-taking

- Discourage gambling behavior

With funded accounts up to $400K and profit splits up to 90%, disciplined traders can scale their capital and prove themselves in a professional trading environment.

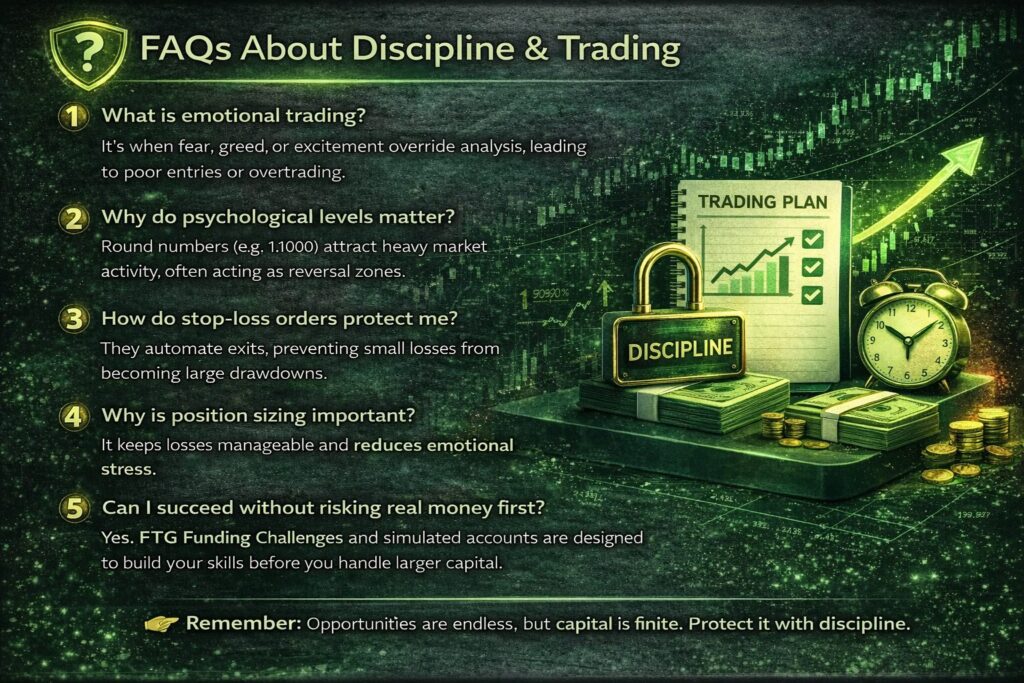

❓ FAQs About Discipline & Trading

1. What is emotional trading?

It’s when fear, greed, or excitement override analysis, leading to poor entries or overtrading.

2. Why do psychological levels matter?

Round numbers (e.g., 1.1000) attract heavy market activity, often acting as reversal zones.

3. How do stop-loss orders protect me?

They automate exits, preventing small losses from becoming large drawdowns.

4. Why is position sizing important?

It keeps losses manageable and reduces emotional stress.

5. Can I succeed without risking real money first?

Yes. FTG Funding Challenges and simulated accounts are designed to build your skills before you handle larger capital.

🚀 Final Word

The market rewards discipline, not emotion. At FTG Funding, we partner with traders who prove they can remain consistent under pressure.

👉 Ready to show not just your strategy, but also your mindset?

Start your FTG Funding Challenge today and take the first step toward becoming a successful funded trader.