Prop trading offers one of the most powerful opportunities in modern trading: access to significant capital without risking your own funds. However, while many traders are drawn to this model, only a small percentage manage to stay consistent long enough to succeed.

The reason is rarely strategy alone.

Most failures in prop trading come from repeatable behavioral and structural mistakes — mistakes that can be avoided with the right mindset, preparation, and discipline.

At FTG Funding, we see the same patterns again and again. This article breaks down the most common prop trading mistakes and shows you how to avoid them so you can trade with confidence, control, and consistency.

Mistake #1: Treating the Evaluation Like a Gamble

One of the fastest ways to fail a prop trading challenge is approaching it with a “nothing to lose” mentality. Traders over-risk, overtrade, and chase profits aggressively, believing the account is disposable.

In reality, prop trading rewards capital preservation, not gambling.

How to avoid it:

Treat your FTG Funding evaluation as if it were already a funded account. Focus on risk control, not speed. Passing consistently matters more than passing quickly.

Mistake #2: Trading Without Clear Rules

Many traders believe they have a strategy, but when pressed, they cannot clearly define:

- Exact entry conditions

- Stop-loss placement

- Exit logic

- Maximum risk per trade

Without rules, trading decisions become emotional reactions to price movement.

How to avoid it:

Create a written trading plan before placing a single trade. If you can’t explain your rules clearly, you’re not ready to execute them consistently.

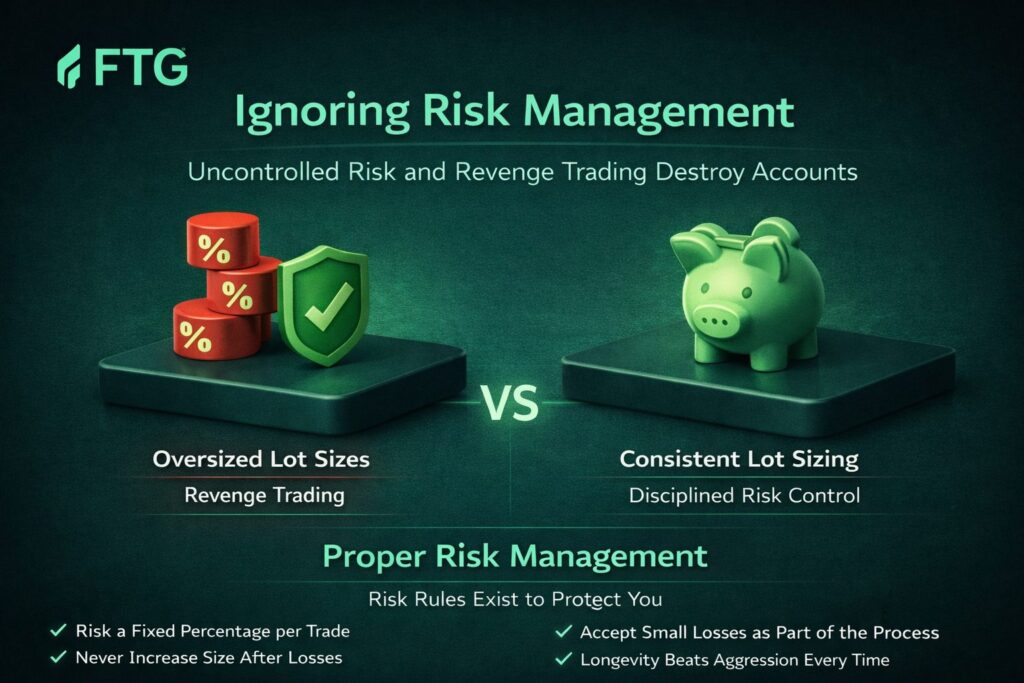

Mistake #3: Ignoring Risk Management

Even a profitable strategy can fail if risk is unmanaged. Oversized positions, inconsistent lot sizing, and emotional revenge trading are some of the most common account killers.

At FTG Funding, risk rules are not obstacles — they exist to protect you from yourself.

How to avoid it:

- Risk a fixed percentage per trade

- Never increase size after losses

- Accept small losses as part of the process

Longevity beats aggression every time.

Mistake #4: Chasing Trades Out of Boredom

Markets do not provide high-quality setups at all times. Traders who feel the need to be constantly active often enter low-probability trades just to “stay busy.”

This slowly erodes discipline and leads to unnecessary drawdowns.

How to avoid it:

Set defined trading sessions and step away when conditions are not favorable. Not trading is often the most professional decision you can make.

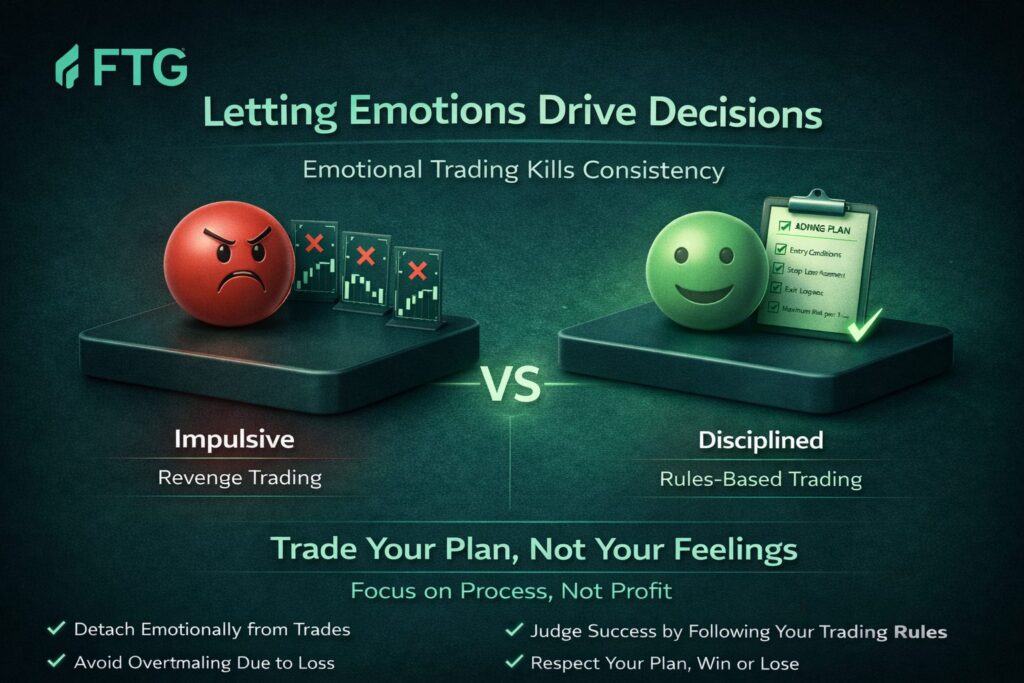

Mistake #5: Letting Emotions Drive Decisions

Fear, greed, frustration, and ego influence more trades than most traders are willing to admit. Emotional trading often shows up as:

- Closing winners too early

- Letting losers run

- Revenge trading after a loss

No prop firm can protect you from emotional decisions — only discipline can.

How to avoid it:

Detach emotionally from individual trades. Judge success by how well you followed your rules, not by whether a trade was profitable.

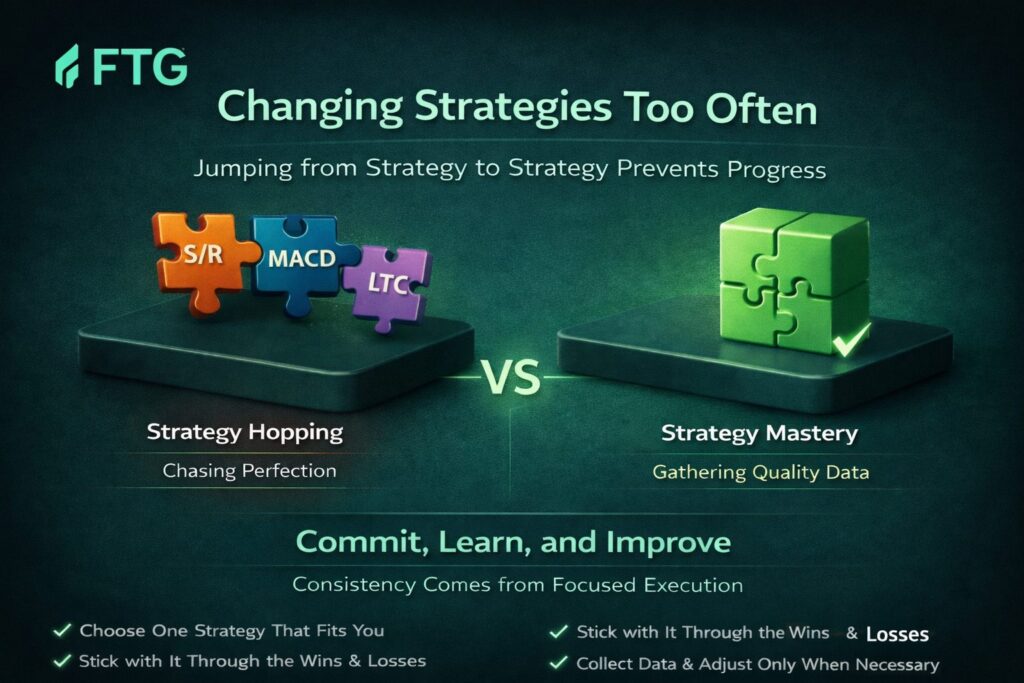

Mistake #6: Changing Strategies Too Often

Many traders jump from one system to another after a short losing streak, constantly searching for the “perfect strategy.” This prevents them from gathering enough data to understand what actually works.

Consistency comes from mastery, not novelty.

How to avoid it:

Choose one strategy that fits your personality and trading schedule. Commit to it long enough to collect meaningful performance data before making adjustments.

Mistake #7: Ignoring Higher-Timeframe Context

Trading against the broader market direction without a clear plan often leads to unnecessary losses. Counter-trend trades can work, but only with precision and strict rules.

How to avoid it:

Always understand the higher-timeframe structure before entering trades. Let the bigger picture guide your decision-making, even if you trade lower timeframes.

Mistake #8: Poor Trade Journaling (or None at All)

Without a journal, traders rely on memory — and memory is unreliable. Patterns of success and failure remain hidden when trades are not reviewed objectively.

How to avoid it:

Log every trade, including:

- Entry and exit reasoning

- Risk taken

- Emotional state

Your journal is one of the most powerful tools for improvement.

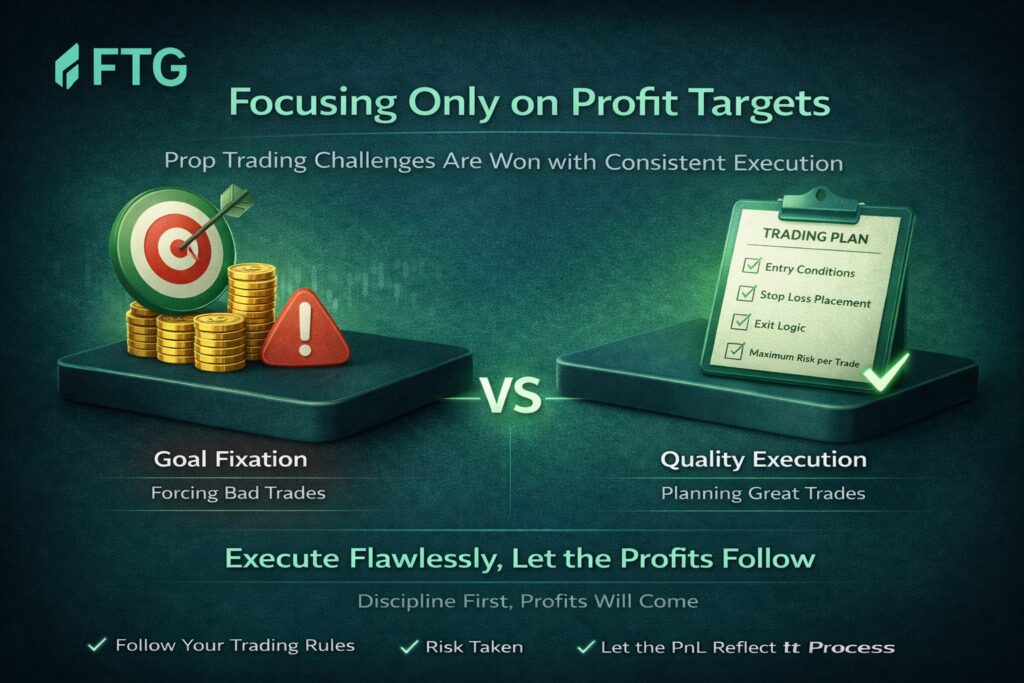

Mistake #9: Focusing Only on Profit Targets

Prop trading challenges are not won by chasing profit targets alone. Traders who fixate on the goal often force trades that don’t meet their criteria.

The market does not care about your objectives.

How to avoid it:

Focus on execution quality. When discipline is consistent, profits follow naturally. Let results be the by-product, not the obsession.

Mistake #10: Underestimating the Importance of Discipline

Discipline is what separates funded traders from failed attempts. It is not about motivation or confidence — it is about repeating the same correct actions every day, regardless of recent outcomes.

How to avoid it:

Build routines. Respect rules. Accept that some days are flat or unproductive. Professional trading is boring — and that’s a good thing.

How FTG Funding Supports Trader Success

FTG Funding is built around one core principle: consistency over hype.

Our evaluation structure encourages traders to:

- Control risk

- Trade responsibly

- Develop professional habits

- Focus on long-term performance

Success in prop trading is not about one trade, one day, or one lucky streak. It is about showing that you can manage capital responsibly over time.

Final Thoughts

Every trader makes mistakes — the difference lies in whether they repeat them.

Prop trading success comes from awareness, discipline, and patience. When traders stop chasing shortcuts and start respecting the process, results improve naturally.

At FTG Funding, we don’t look for perfect traders. We look for consistent ones.

Avoid these mistakes, trade with intention, and give yourself the best possible chance to succeed.