FTG Funding – Market Insights

In the world of forex trading, certain currency pairs move in ways that reflect deep underlying macroeconomic forces. One of the most reliable and consistently tradable relationships is the correlation between USDCHF and global risk sentiment. Unlike commodity-tied currencies or complex intermarket relationships, the USDCHF pair offers something unique: clarity.

At the core of this relationship is a simple truth:

The Swiss franc (CHF) is one of the world’s strongest safe-haven currencies.

This single fact creates a powerful dynamic in USDCHF:

- Risk-off → CHF strengthens → USDCHF falls

- Risk-on → CHF weakens → USDCHF rises

Understanding this correlation gives FTG traders an instant edge in navigating volatility, interpreting macro events, and positioning confidently on USD-linked pairs.

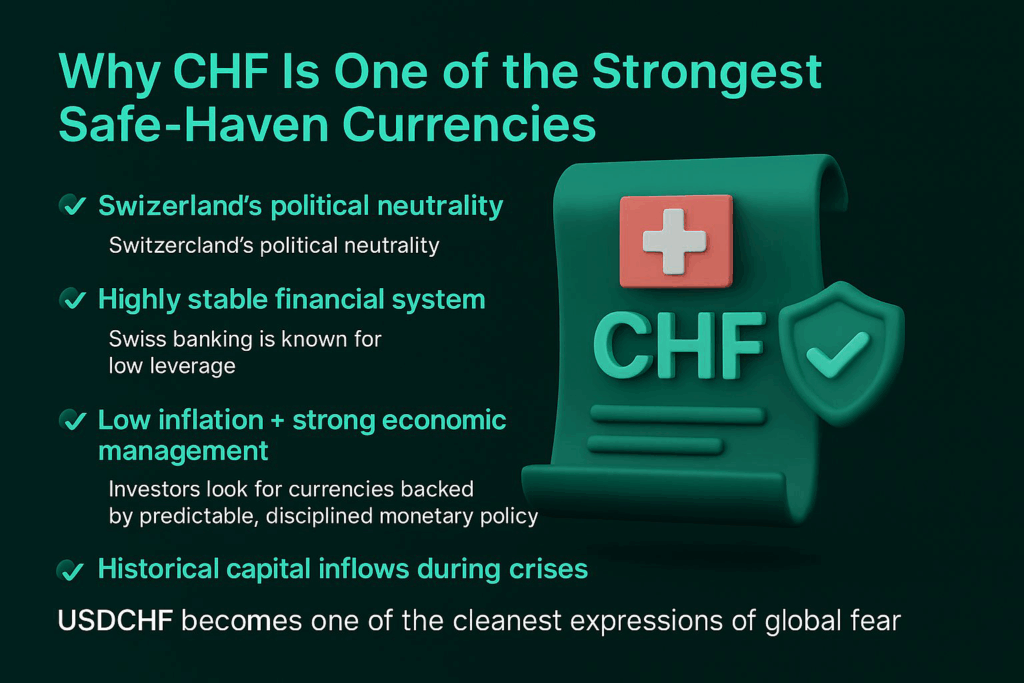

1. Why CHF Is One of the Strongest Safe-Haven Currencies

The Swiss franc is considered one of the world’s most trusted currencies during market turmoil. This reputation is built on several core fundamentals:

✔ Switzerland’s political neutrality

The country avoids geopolitical conflicts, making it a global “safe parking place” for capital.

✔ Highly stable financial system

Swiss banking is known for low leverage, liquidity, and decades of stability.

✔ Low inflation + strong economic management

Investors look for currencies backed by predictable, disciplined monetary policy.

✔ Historical capital inflows during crises

Across decades—recessions, wars, market crashes—money flows into CHF as fear rises.

Because of this, when global markets panic, CHF attracts more aggressive inflows than even the USD, Japan’s yen, or government bonds.

This is why USDCHF becomes one of the cleanest expressions of global fear.

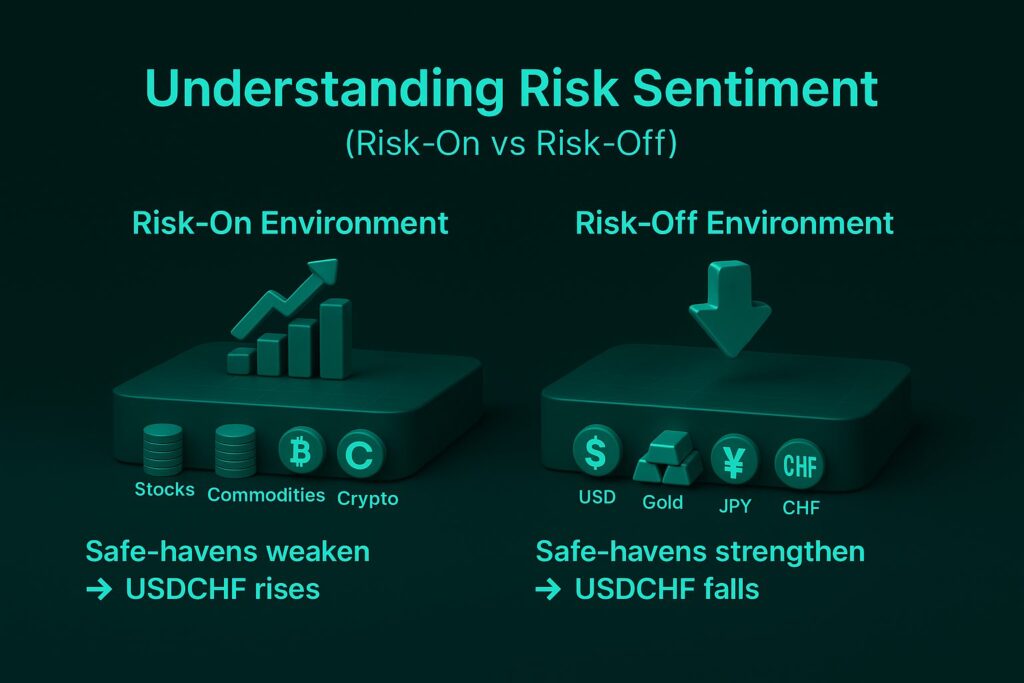

2. Understanding Risk Sentiment (Risk-On vs Risk-Off)

Before trading USDCHF, traders must understand risk sentiment, the market’s collective appetite for or aversion to risk.

Risk-On Environment

Markets are optimistic.

Investors buy:

- Stocks

- Commodities

- Crypto

- High-yield currencies (AUD, NZD, GBP)

Safe-havens weaken → USDCHF rises

Risk-Off Environment

Markets are fearful.

Investors rush into:

- Bonds

- USD

- Gold

- JPY

- CHF

Safe-havens strengthen → USDCHF falls

USDCHF moves almost like a mirror of global fear vs confidence.

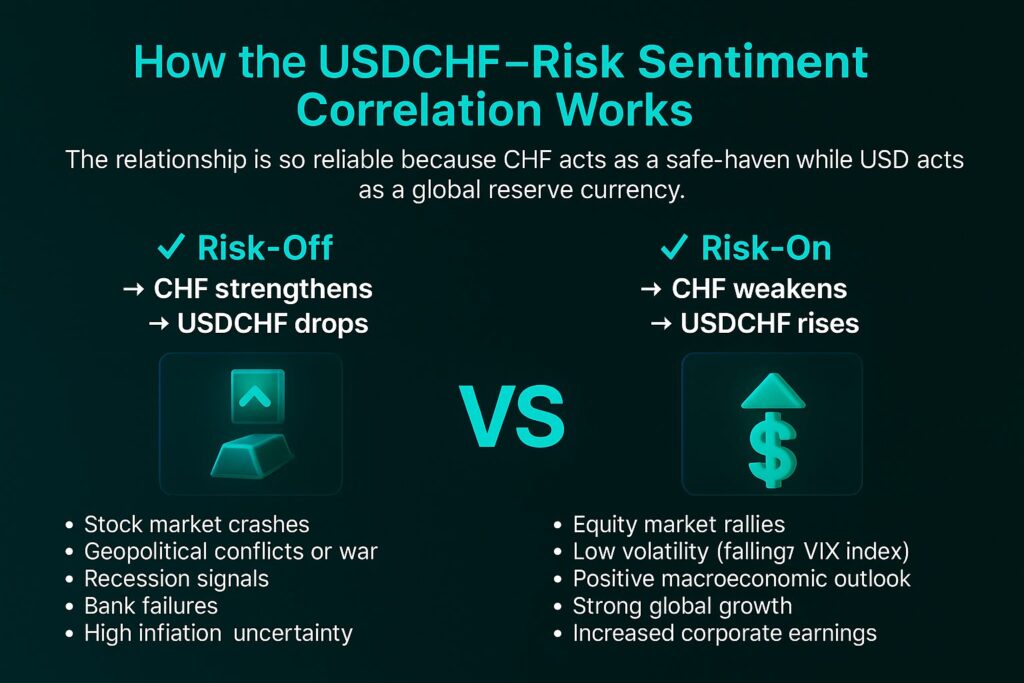

3. How the USDCHF–Risk Sentiment Correlation Works

The relationship is so reliable because CHF acts as a safe-haven while USD acts as a global reserve currency. Under normal conditions, USD is already strong—but during intense fear, CHF becomes even stronger.

✔ Risk-Off → CHF strengthens → USDCHF drops

Examples include:

- Stock market crashes

- Geopolitical conflicts or war

- Recession signals

- Bank failures

- High inflation uncertainty

- Global liquidity shortages

During these events, investors aggressively buy CHF, causing USDCHF to fall rapidly.

✔ Risk-On → CHF weakens → USDCHF rises

Examples include:

- Equity market rallies

- Low volatility (falling VIX index)

- Positive macroeconomic outlook

- Strong global growth

- Increased corporate earnings

During risk-on environments, CHF loses demand, while USD typically stays stable or strong—resulting in USDCHF climbing.

4. Historical Examples Where USDCHF Reacted Perfectly

USDCHF repeatedly confirms its safe-haven correlation through major global events:

• 2008 Global Financial Crisis

Fear peaked → CHF surged → USDCHF collapsed.

• 2015 Swiss Franc Shock

CHF soared after the SNB removed the EURCHF peg—one of the most extreme safe-haven reactions ever recorded.

• 2020 COVID Crash

As global markets melted down, CHF strengthened sharply → USDCHF dropped aggressively.

• 2022 Russia–Ukraine Conflict

Geopolitical uncertainty increased CHF demand → USDCHF volatility spiked.

• 2023 Banking Crisis (Credit Suisse → UBS takeover)

Ironically, even during Swiss banking uncertainty, CHF still acted like a safe-haven as global fear intensified.

Across decades of data, the pattern remains extremely consistent.

5. Why USDCHF Is One of the Cleanest Macro Correlations

USDCHF stands out because:

✔ It is not tied to commodities

There is no oil or gold dependency complicating price movements.

✔ It reacts directly to global volatility

VIX up → USDCHF tends to fall

VIX down → USDCHF tends to rise

✔ It responds quickly to sentiment shifts

Minutes after macro events, USDCHF often reacts before other FX pairs.

✔ Easy to interpret for traders

Fear = CHF up.

Optimism = CHF down.

This simplicity makes it ideal for FTG traders building macro awareness.

6. How FTG Traders Can Apply This in Real Trading

Here are actionable insights for FTG Funding traders:

1. Use USDCHF as a risk sentiment indicator

When USDCHF is dumping, the market is risk-off → expect weakness in indices and risk currencies.

2. Watch the VIX Index

Rising VIX usually aligns with CHF strength → bearish USDCHF bias.

3. Use USDCHF for directional bias on other USD pairs

If USDCHF is falling but EURUSD is flat → sentiment is likely risk-off (bearish for indices, crypto).

4. Adjust stop placement based on volatility

Risk-off markets create sharper spikes—wider buffers are recommended.

5. Combine USD and Swiss data

Monitor:

- SNB interest rate decisions

- Fed policy

- Global equity performance

- Safe-haven flows (gold, bonds, JPY)

USDCHF becomes even clearer when these factors align.

7. When the Correlation Weakens

Although USDCHF is one of the cleanest correlations in FX, certain conditions can temporarily distort it:

- SNB intervention

- Extreme USD cycles

- Unexpected macro events

- Diverging monetary policies

- Large central bank inflows/outflows

However, these distortions are usually temporary.

Once the macro environment stabilizes, the safe-haven flow dynamic returns.

Conclusion

The USDCHF–risk sentiment correlation is one of the most powerful and reliable relationships in forex. Because CHF is a premier safe-haven, it moves in near-perfect alignment with global fear and confidence.

Risk-off → CHF strengthens → USDCHF falls

Risk-on → CHF weakens → USDCHF rises

For FTG Funding traders, understanding this correlation is not optional—it is a competitive advantage.

It helps you:

- Predict volatility

- Avoid incorrect bias

- Understand global macro flows

- Position confidently on USD pairs and risk assets

Trading is not just about charts—

It’s about understanding what moves the market behind the chart.

Master this correlation, and you elevate your trading edge at FTG significantly.